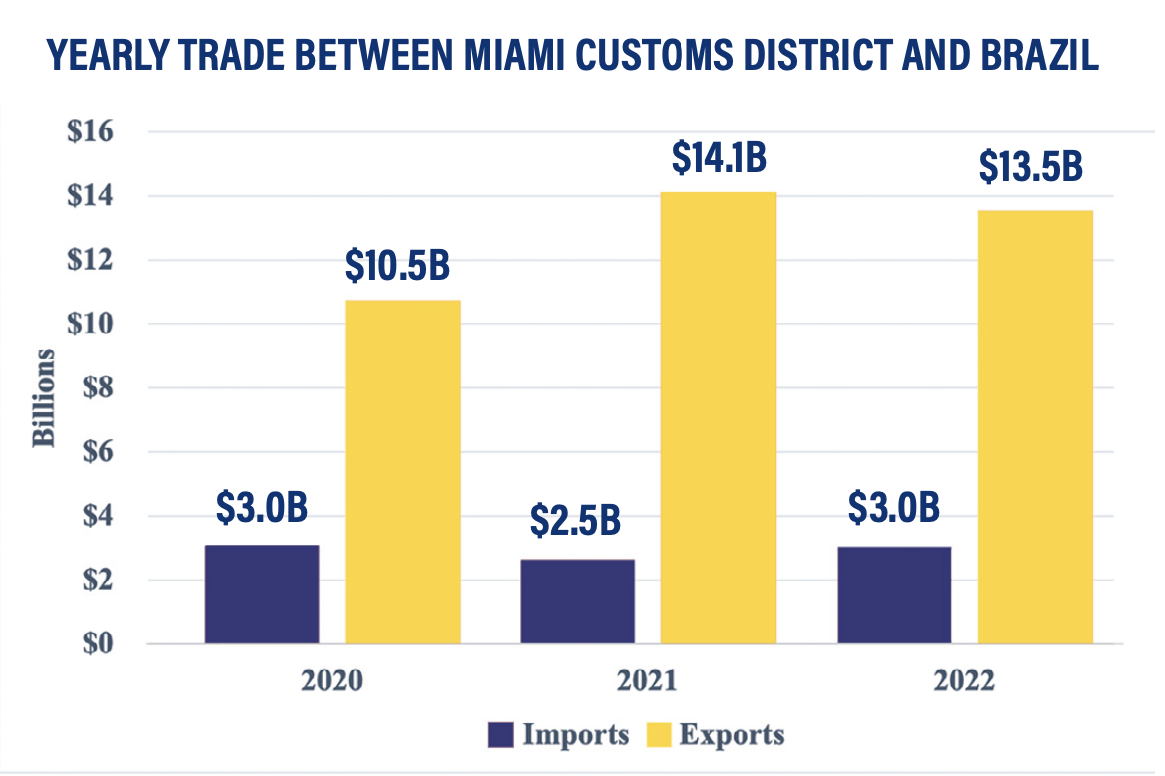

Bilateral trade between Brazil and the Miami Customs District slipped just slightly in 2022, but remains the leading source of trade surpluses

By Yousra Benkirane

Brazil has been the top trading partner with the Miami Customs District for more than a decade, with bilateral trade reaching a peak of $16.72 billion in 2021. Last year, that slipped slightly to $16.52 billion, thanks to a decline in exports of telephones (-88.7%) and integrated circuits (-4.87%), and despite a surge in exports of aircraft parts (6.45%) and computer products (14.3%). Even so, Miami’s 2022 exports to Brazil of $13.5 billion, while down 4.26% from 2021, still surpassed its 2019 pre-pandemic level of $11.7 billion.

Meanwhile, imports from Brazil rose 15.1% in 2022 to $3.02 billion, driven by purchases of aircraft parts (from $0 in 2021 to $66.8 million in 2022) and handguns (from $54.1 million in 2021 to $131 million in 2022, a jump of 142%). Most of the imported guns come from Brazilian manufacturer Taurus, which exports 98% of its handguns through Ft. Lauderdale-Hollywood International Airport (FLL), making it one of the most valuable imports at FLL. The uptick in imports overall was driven in part by a favorable exchange rate of Brazilian reals to U.S. dollars.

In terms of ports of entry, Brazil remains Miami International Airport’s (MIA) number one trading partner despite a small decrease in annual trade (-5.46%) in 2022 (to $12.97B). Exports fell 7.58% to $11.17 billion but imports rose 10.14% to $1.81 billion. According to the U.S. Census Bureau, 2022 trade with Brazil at MIA was almost twice the level as No. 2 Colombia ($6.57B), followed by Chile ($5.53B), the UK ($4.24B), and Argentina ($3.21B). By tonnage, the top five trade partners were Colombia, Chile, Brazil, Ecuador, and Costa Rica. Brazil also represented the top trade surplus for MIA (exports exceeding imports) at $9.36 billion, followed by Argentina ($2.17B) and Paraguay ($1.62B).

At PortMiami, bilateral trade with Brazil declined significantly in 2022, with exports to Brazil down by 21.9% to $27.4 million, led by reduced shipments of integrated circuits (-45.6%), recovered paper (-95.2%), and thermostats (-88.9%). Imports from Brazil at PortMiami fell even more sharply, dropping 64.2% to $26.7 million in 2022. The decrease was led by fewer shipments of dental products (-33.3%), pig meat (-90%), spices (-87.8%), building stone (57.8%), and sawn wood (-98.8%). Interestingly, however, bilateral trade between Port Everglades and Brazil, its third top trading partner, rose 21.39% to $2.22 billion in 2022. Exports led the way, up by 22.28% to $1.45 billion, followed by imports rising 19.73% to $768 million. Key commodities for export were aircraft parts ($76.4M), industrial printers ($83.3M), and medical instruments ($42.2M), with leading imports of stone ($81.1M), plywood ($51.2M), and uncoated paper ($50.1M). Even at No. 3, trade with Brazil was the top surplus for Port Everglades at $680.31 million, followed by Venezuela ($641.76M) and Chile ($588.03M).

Sources: PortMiami, The Observatory of Economic Complexity, U.S. Census Bureau, Miami International Airport, Port Everglades