GETTING CONNECTD IN MIAMI

When Roei Samuel was looking to expand his UK-based start-up platform Connectd to the United States, Miami seemed like the obvious place to begin. Outside of direct flights to London, nice weather, and a favorable tax climate, the city’s status as a burgeoning tech hub made it a perfect launching pad.

Samuel founded Connectd in 2020 after previously investing in several startups. That experience convinced him there was a correlation between startups that performed well and two key ingredients: frequent interactions with investors and access to a network of experts. So, he founded Connectd to “connect” the triad of players in the start-up ecosystem: founders, investors, and experts. The platform was designed with that simple mission in mind – to help founders streamline their financial reporting, meet new investors, and gain access to experts who could help jumpstart their company. Investors were also given the chance to back start-ups that regularly report.

After initial success in London’s bustling start-up community, Samuel had considered expanding into the U.S. via Silicon Valley. But that start-up community seemed too entrenched compared with Miami. “In emerging tech ecosystems like Miami, there are so many new entrants. There are so many new players, so many new people coming to town,” says Samuel. “And being able to discover people is key for us.”

Connectd is one of a profusion of UK-based companies that are finding success in Miami. In recent years, particularly post-Brexit, there has been an uptick in UK companies expanding to South Florida, paralleling the larger trade relationship between the UK and Florida as a whole.

GENERAL TRENDS IN UK-MIAMI TRADE

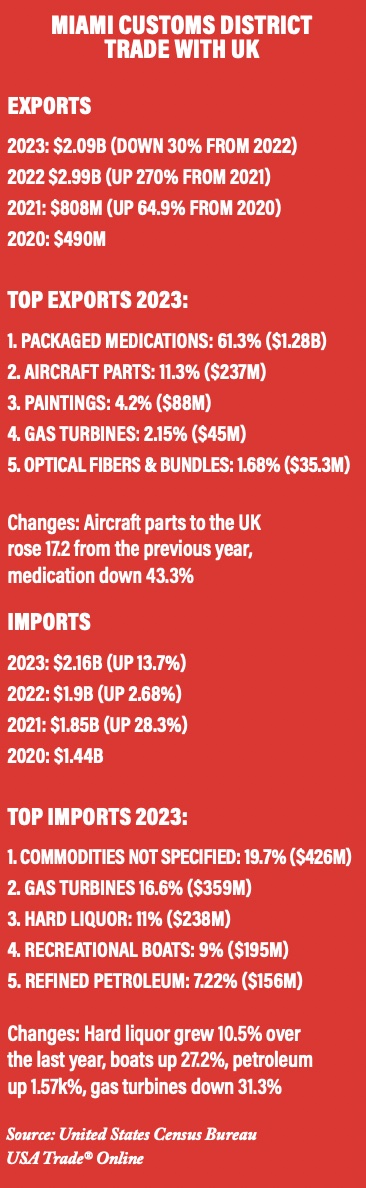

From the approximately one million British tourists that visit Florida every year to British companies that employ roughly 70,000 people in the state, it’s clear that economic ties between the UK and Florida run deep. In 2022, bilateral trade between the UK and Florida totaled $5.8B, growing 119% over the preceding five years and making the UK Florida’s 8th largest trading partner. The lion’s share of that trade roared through Miami that year – some $4.89B – and though it tapered off by some $640M last year (due largely to a 43.3% decrease in packaged medication exports to the UK) it was still significant enough to prompt Governor Ron DeSantis to sign a Memorandum of Understanding (MoU) with the UK last year to further facilitate trade.

Although not a legally binding contract, the MoU serves to bolster bilateral trade by reducing barriers to entry and streamlining the process for UK companies to do business in Florida and vice versa. Outside of trade, its goals are to grow academic partnerships between institutions in the UK and Florida and promote cooperation in high-priority sectors like aerospace technology, fintech, legal services, medtech, supply chain logistics, transport, infrastructure, and agricultural biotechnology. “The political outreach and engagement are really important,” says the UK’s Consul General in Miami, Rufus Drabble. “British FDI [Foreign Direct Investment] is still number one in Florida… and I’m delighted to say we’re [also] number two in terms of international tourists to Florida, including Miami. Sadly, the Canadians consistently beat us, not that we have a competition. But the Brits bring a lot of money. We tend to spend more… In 2021, British tourists spent $323 million in Miami-Dade County.”

More to the point for Miami’s future as a tech hub are British companies investing in innovative niche areas. Like some of the priorities listed in the MoU, UK-Miami trade and investment mostly center around fintech, aviation and aerospace, as well as medtech. Last year, top exports to the UK through Miami included packaged medications ($1.28B) and aircraft parts ($237M), while top imports included gas turbines ($359M). That was followed by hard liquor ($238M), with growing imports of British-made alcoholic beverages (see story pg. 20).

“We’re not trying to do everything that we’re good at, but we’re trying to pick a few where we think, not only can we add value collaboratively for both UK and Florida companies, but we’re trying to get ahead of the curve – not just invest in what’s happening now but where we think things are going to go,” says Drabble.

Fintech company Floww is another example of a UK-based company that’s looking to capitalize on Miami’s emergence as a tech hub and the VC dollars it attracts. The company recently opened an office in Miami to expand its London operation. Floww’s goal is to make investing in private companies as easy as publicly traded companies.

By combining regulatory, legal, data, and workflow solutions, the company’s goals are to reduce the complexity of private markets and open new capitalization routes for private companies, assets, and funds. With Miami’s growing start-up ecosystem, shared language, daily direct flights, and business-friendly environment, it made sense for Floww to expand via Miami rather than New York or California.

The presence of companies like Connectd and Floww represents a growing exchange of ideas and collaboration between the UK’s own global tech hub, London, and Florida’s Miami. “As Miami has matured and developed more of an international business community, there’s just been an organic and natural growth of the British investment in South Florida,” says British-native David Archer, President of the British American Business Council, and attorney for Hinshaw & Culbertson. “I think part of it is that Florida is pretty open for business, whereas a lot of other places have more restrictive regulations. [Consequently] we’ve seen a lot of new businesses coming into South Florida from the UK.” Connectd and Floww exemplify the fintech firms coming out of the UK and how they can benefit Miami’s tech ecosystem in particular and Florida in general.

“The UK has a strong reputation in innovation and tech companies. And we’re seeing more of that cross-pollination between the UK and South Florida,” says Tansy Jefferies, tax advisor for RSM and treasurer of the British American Business Council. “The [British] government was recently here in Florida, and one of the areas of focus in that discussion was the fintech industry. It’s something that the governments on both sides are recognizing and aiming to find ways to help businesses collaborate and do business more easily across jurisdictions.”

And while Miami is the spigot through which most of the trade between the UK and Florida passes, it is also the state as a whole that intrigues British investors.

“Florida has one of the largest economies of any U.S. state, with a recipe for success that includes a low-tax/low-regulation environment, a strategically important location, and a diverse set of industries with nationally important clusters spread across the state. This is an attractive prospect for UK companies looking to break into the U.S. market. With over $30 billion in VC investment raised in Florida since 2018, the state is among the leading states in the U.S. for tech investment,” says Harrison Lance, senior trade & investment officer at the British Consulate in Atlanta.

UK Secretary of State Kemi Badenoch echoed Lance’s remarks at the MoU signing with DeSantis. “Florida is a major economy in its own right, with a bigger GDP than most European countries,” said Badenoch. “From launching satellites to developing the latest fintech software, Florida’s leading high-tech companies offer huge opportunities to the UK’s rapidly expanding tech sector.”