The Miami Customs District continues to dominate U.S. fish fillet imports

Driven by a high demand for healthy protein and the lack of national aquaculture production, the United States has historically taken the lead as the world’s largest importer of fish fillets – with South Florida having long led the nation in the flow of fish into the country.

In past decades, the leading origin of fish fillet imports into the U.S. has shifted from Canada (1994-1999) to Chile (2000-2004) to China (2005-2015) and back to Chile (2016-present). For the Miami Customs District, Chile has typically been the top source of fish fillets. Those imports, mostly chilled salmon, fly into Miami International Airport, the U.S.’s leading port of entry for perishables. Imports from China, generally frozen tilapia, are mostly shipped into the Port of Los Angeles.

Of the $5.47B worth of fish fillets that the U.S. imported through August of this year, 35.9 percent came through Florida ($2.09B). Of those imports, 83.6 percent – or $1.75B worth – came through ports in the Miami Customs District (MCD).

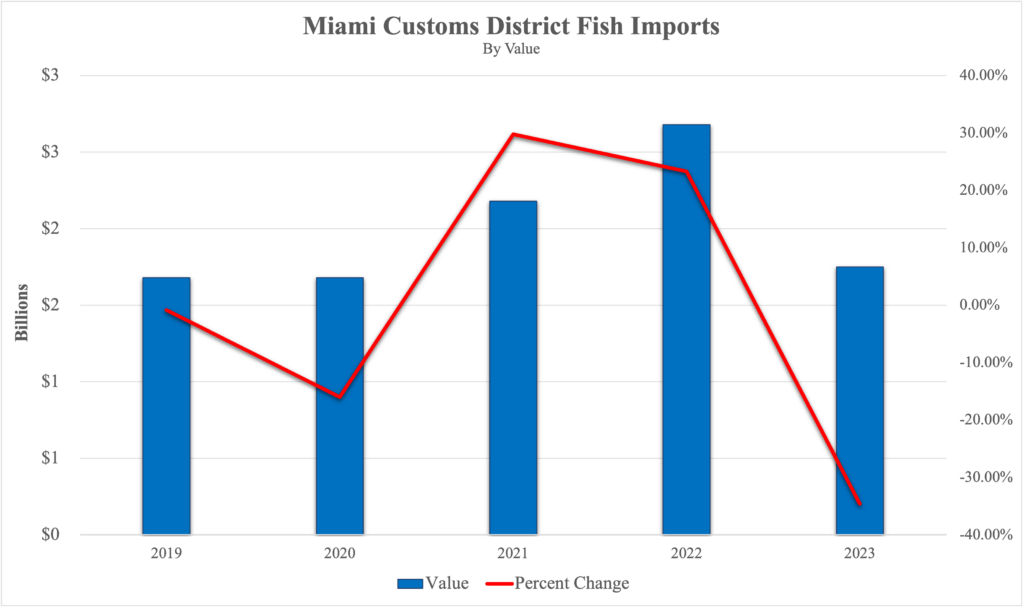

Fish fillets (fresh, chilled, or frozen) rank as the MCD’s third most valuable import, trailing behind only gold ($2.22B) and telephones ($1.99B). Through August of this year, MCD imported $1.75B worth of fish fillets. While that represents a decline of 34.6 percent from the previous year (due to a 41.5 percent decrease in imports from China), this figure remains 4.1 percent higher than pre-pandemic (2019 & 2020) levels.

On the export side, MCD exported $22.5M worth of fish, mostly to neighboring Caribbean countries like the Dominican Republic ($3.83M) and the Bahamas ($1.1M).

Chile, the leading source of fish fillet imports to MCD, dominated the total with $1.27B through August, followed by Norway ($58.1M), and Colombia ($55.1M). As the world’s largest producer of farmed salmon, Norway is the U.S.’s second most valuable source of fish, albeit not through South Florida.

For Chile, salmon is the country’s largest food and agricultural export and the second-largest total export sector after copper. China no longer makes the top ten for the MCD, with imports having decreased to only $16.3M through August of 2023. In terms of sources from Asia, Indonesia has overtaken China; overall, it’s MCD’s fourth most valuable source of fish ($39.5M), largely consisting of tuna, snapper, and grouper.

Since the deepening of the PortMiami channel, the district has been able to accommodate larger Asian ships freighted with frozen fish and other goods coming from Indonesia, Vietnam, and India. Yet only $434M worth of fish come through the District’s main seaports, with the Miami International Airport handling the rest. Port Everglades handles the most ($254M), overwhelmingly from Chile (67.5 percent) and India (12.5 percent). PortMiami comes in second at $180M, with 22 percent coming from Indonesia, 17.7 percent from Ecuador, and 17.6 percent from Vietnam.

Miami International Airport (MIA), as the main point of entry for air perishables to the U.S. (accounting for approximately 70 percent of all U.S. perishable imports like fruits, vegetables, and seafood) handles $1.31B worth of fish. It has 466,372 square feet of on-airport refrigerated warehouse space, approximately 16 percent of its total on-airport warehouse space. Private logistics facilities just outside the airport and in the nearby City of Doral also have significant refrigeration capacity.

Overall, the Miami Customs District has established itself as a linchpin in the supply chain of U.S. fish imports. As South Florida charts a robust growth trajectory in this sector, it anticipates competing with Los Angeles, as Chile contends with China for dominance as the primary fish supplier for U.S. markets.