FOREWORD: THE TAIWANESE PRESENCE

By Director General Charles Chou, Taipei Economic and Cultural Office in Miami

One of the questions I hear most often as Director General of the Taipei Economic and Cultural Office in Miami is: what industries are Taiwanese people in Florida working in today?

Given the vast geographic distance between Taiwan and Miami, it may be hard to imagine a significant Taiwanese business presence in this region – especially when it isn’t always visible in the public eye. Yet Taiwan has long enjoyed a mutually beneficial economic relationship with both the United States and the state of Florida.

As of 2024, Taiwan is the United States’ 7th largest trading partner and the United States is Taiwan’s 2nd largest trading partner, with two-way trade totaling an impressive $158.6 billion. Moreover, over 40% of Taiwan’s outbound investments go to the United States.

Minister of Foreign Affairs of Taiwan Lin Chia-Lung further expanded on this relationship in a recent editorial article titled “Strategic opportunities for Taiwan-US relations following US President Trump’s first 100 days in office.” On the topic of increased investments in the United States, he emphasizes that Taiwan “must actively seize the enormous business opportunities created by the development of AI and advance two-way investment between Taiwan and the US.” He states that this will allow Taiwan to “utilize US advantages in technology, capital, and talent to strengthen Taiwan and integrate its businesses into the US innovation ecosystem.”

These remarks from our Minister of Foreign Affairs truly underscore the commitment Taiwan is making to increase its investments and further integrate into the United States’ economic landscape. On a more local scale, Taiwan ranks as Florida’s 9th largest merchandise trade partner in the Indo-Pacific region, underscoring the strength of our commercial ties. Still, for many, Taiwan’s presence in South Florida – particularly in Miami – remains relatively under-recognized.

Many are surprised to learn that Taiwanese businesses have had a presence in Miami since the early 1990s. At that time, a wave of companies in the computer and electronics sectors viewed Miami as a strategic gateway to Latin America, establishing operations to access broader markets. However, as the global technology landscape evolved, many of those businesses relocated or shifted their strategies.

Today, the Taiwanese community in South Florida is more diverse and widespread than ever. No longer limited to the tech sector, Taiwanese professionals and entrepreneurs can now be found across a range of sectors. This report highlights just a few success stories: from BioTissue and OPKO Health advancing biomedical innovation, to financial services provided by Amerasia Bank, and inspiring entrepreneurial ventures such as Lee Fisher Fishing Supply. Their adaptability and dedication have allowed them to become deeply embedded in the local economy while maintaining strong cultural connections to their home country of Taiwan.

This report shines a light on a community that is laying the groundwork for further cooperation between our two regions and enriching the multicultural identity of Miami and Florida through the meaningful contributions of Taiwanese businesses to the region’s growth.

The View from Taiwan

Innovation, ingenuity and resolve reign in this remote but crucial democracy despite the ongoing threat from the People’s Republic of China

By Drew Limsky

Representing the scale of ambition and innovation of Taiwan, Taipei 101, a marvel of a skyscraper, rises above this capital city of 2.5 million people. Taipei 101 held the title of the world’s tallest building for five years, starting with its completion on New Year’s Eve in 2004, and today remains the tallest building in Taiwan and the 11th tallest in the world.

Taipei 101 is easily Taiwan’s most iconic landmark, with a sharp silhouette identifiable around the world. Wrapped in aluminum and heat-reducing, blue-green glass curtain walls, the C.Y. Lee and C.P. Wang-designed tower is named for its 101 stories. At the time of its debut, it also ranked as the world’s tallest LEED Platinum-certified building. At its unveiling, the tower boasted the world’s fastest elevators, and it still contains the largest damper ball in the world – an internal steel pendulum that counterbalances typhoon-force winds.

Decoratively, this elegant yet fanciful stack of 3D trapezoids is among the finest examples of postmodern Asian skyscraper architecture, with traditional motifs inventively reimagined: Nods to pagodas, bamboo shoots, and a Chinese ceremonial scepter called a ruyi are all discernible in its design.

At its opening,Taipei 101 seemed designed to make a defiant statement to PRC (People’s Republic of China), which is what Taiwanese officials call mainland China. (For its part,Taiwan’s official name is the Republic of China – ROC). But the shadow of the PRC is long, and between 2015 and 2019, China saw the construction of five supertowers – all of them taller than Taipei 101 – to make its own statement.

After a tumultuous history, culminating in a 50-year period (1895 to 1945) when it was under Japanese rule, this island nation of just under 14,000 square miles was established in 1949 by Gen. Chiang Kaishek, the Chinese leader who lost the civil war against Mao Zedong’s communists. With a series of reforms beginning in the 1970s, Taiwan in the 1990s emerged as a Western-friendly democracy.

The ROC is not officially recognized by the United Nations, but the U.S. has maintained friendly “unofficial” commercial and cultural ties with Taiwan since the Taiwan Relations Act was enacted in 1979 – the same year that the U.S. established diplomatic relations with China, recognizing Beijing as China’s sole legitimate government (i.e. the “One China” policy).

The U.S. has since cultivated a delicate balance in the region, not wanting to provoke aggression from its adversary, the PRC – avoiding recognizing Taiwan as a separate nation or supporting its independence – but suggesting, courtesy of former President Joe Biden, that the U.S. would assist the tiny democracy in its military defense.

That balance may be due for an upset: Chinese President Xi Jinping has ordered the People’s Liberation Army to be ready to invade Taiwan by 2027, and that year, 2027, is a ubiquitous utterance in Taipei, repeated at every briefing and news conference. PRC, with its escalation of war games around Taiwan, regards ROC as one of its provinces; what Taiwan and the West view as war, Beijing regards as reunification, while both governments see themselves as the “real” China.

DIPLOMATIC DANCE

At a press briefing in May, Taiwan’s foreign minister Foreign Minister Lin Chia-lung was candid: “What the nature is of cross-Taiwan Strait relations can be discussed, but we are all human. First, extend the hand of friendship. If [my counterpart] shook my hand, that would be a good start. If he takes his hand back, that’s his problem.”

Given that dynamic, building up the country’s defenses and emergency response has become a common theme among Taiwan’s diplomats. Complicating matters is the unpredictability of the Trump Administration. However, Deputy Minister Liang Wen-chieh believes that Taiwan has “allies in the Republican party,” including U.S. Secretary of State Marco Rubio and U.S. Secretary of Defense Pete Hegseth.

Densely populated Taiwan has around 24 million inhabitants. Mainland China, which sprawls over 3,700,000 square miles, has a population of more than 1.4 billion. The two are separated by only 112 miles, little more than the distance between New York City and Philadelphia.

But Xi Jinping’s ominous threat is not apparent on Taipei 101’s 89th-floor observation deck, where visitors nibble on egg cakes formed in the shape of the skyscraper and stare at the city’s other architectural stars, such as the twisting Tao Zhu Yin Yuan residential tower that mimics DNA’s double helix, and the Sky Taipei, a new supertall entry by Antonio Citterio and Patricia Viel. The threat from Beijing is also nowhere apparent in the city’s vibrant night market or its alleyway kitchens. With 2027 less than two years away, life goes on in Taipei’s all-you-can-eat hot-pot joints and on its thronged streets buzzing with mopeds.

IN PARTNERSHIP: TAIWAN AND FLORIDA

Florida and Taiwan have enjoyed a trade relationship that goes back decades, and the two have picked up the pace in recent years. By 2022, the total bilateral merchandise trade between Florida and Taiwan was $1.3 billion, making Taiwan Florida’s 4th-largest bilateral merchandise trading partner in the Asia-Pacific region, and 35th largest partner overall, according to FloridaCommerce.

In Miami in January, Florida Department of Commerce Secretary J. Alex Kelly and Taiwan International Trade Administration Director General Cynthia Kiang signed a Memorandum of Understanding to facilitate mutual trade and investment expansion and industrial cooperation between Florida and Taiwan. The focus: the semiconductor (computer chip) manufacturing industry. While Taiwan technically does not have a consular office in Greater Miami, General Director Charles Chi-Yu Chou spearheads the bilateral relationship in his role at the Taipei Economic and Cultural Office, located in Coral Gables.

Nationwide, total goods trade with Taiwan represented an estimated $158.6 billion in 2024, according to the Office of the U.S. Trade Representative. This activity makes Taiwan the 9th-largest trading partner of the U.S., though Taiwan exports far more than it imports from the U.S. The simplest explanation: Taiwan produces more than 80% of the world’s semiconductors and more than 90% of the most high-performance chips.

That output is so important to the ROC that President Lai Ching-te made an appearance as marquee speaker at the Global Semiconductor Supply Chain Partnership Forum. The May gathering brought together more than 700 government officials and industry figures to Taipei’s Industrial Technology Research Institute to hear President Lai stress his view that global democracies – represented at the event by officials from Great Britain, the European Union, Japan, the Netherlands, and the U.S. – must work together, leveraging their respective strengths to ensure a resilient semiconductor supply chain.

When it was his turn to take the stage, Jeremy Cornforth, then-deputy director at the American Institute in Taiwan, emphasized the benefits of the U.S. working with Taiwan, noting their shared commitment to building an “unparalleled” global semiconductor ecosystem. “The United States and Taiwan share a long-standing, symbiotic relationship in the high-tech sector, with semiconductors at its core,” he said. (Cornforth has been a career member of the Senior Foreign Service since 1998; two months after the semiconductor forum, he moved onto a different Asia-Pacific role, as U.S. Consul General Sydney.)

The specter of China lingered over the forum; the PRC casts a shadow over global trade just as it colors perceptions of national security, not just in Taiwan, but around the world. Key speakers addressed the importance of protecting trusted supply chains despite the challenge of China dumping products on the global market at cut-rate prices. “Countries should unite and cooperate as partners in the global semiconductor supply chain to ease the impact of dumping from China,” Lai said. “Otherwise, innovation cannot continue, and industrial development would be affected.”

THE CHIP MAKER

One can see why Lai is protective of Taiwan’s innovation initiatives and its dominance of the global semiconductor market. Its chips, produced mostly through the Taiwan Semiconductor Manufacturing Co. (TSMC), power products from Apple to Nvidia.

TSMC’s achievement is made palpable at the company’s signature Museum of Innovation, which showcases the ways in which TSMC’s increasingly advanced chips become smaller and smaller while still performing the same tasks, thereby bolstering efficiency and reducing energy consumption. The museum displays a Bluetooth headset (which requires an estimated four chips), a webcam (est. five chips), and an automatic coffee machine (est. three chips).

A gallery is dedicated to Dr. Morris Chang, the billionaire founder of TSMC and the father of the global semiconductor industry. Given that chips are used in everything from phones, cars, jets and kitchen appliances to TVs, computers, pacemakers and MRI scanners, his contribution is inestimable.

Chang, a Taiwanese-American, is now 94. Nearly 40 years ago, by returning to Taiwan and founding TSMC, Chang arguably did more than anyone else to forge the enduring technology and trade bonds that connect the U.S. to the ROC. Educated at MIT, Harvard, and Stanford, he revolutionized technology itself. Few know his name, but the impact of Chang’s work figures in virtually every geopolitical decision the U.S. makes with regard to Taiwan. The next few years will determine the urgency and scope of those decisions in an unprecedented way.

The Taiwan Equation

Miami-Taiwan trade deepens as supply chains shift and strategic industries take center stage

By Yousra Benkirane

The trade relationship between the Miami Customs District and Taiwan reflects the deepening economic interdependence between the United States and this strategically vital Asian economy. Often referred to as the “Silicon Island,”Taiwan’s role as a global hub for high-tech manufacturing – especially semiconductors, advanced electronics, and marine equipment – has positioned it as a steadily growing partner in Miami’s trade landscape and the broader global supply chain.

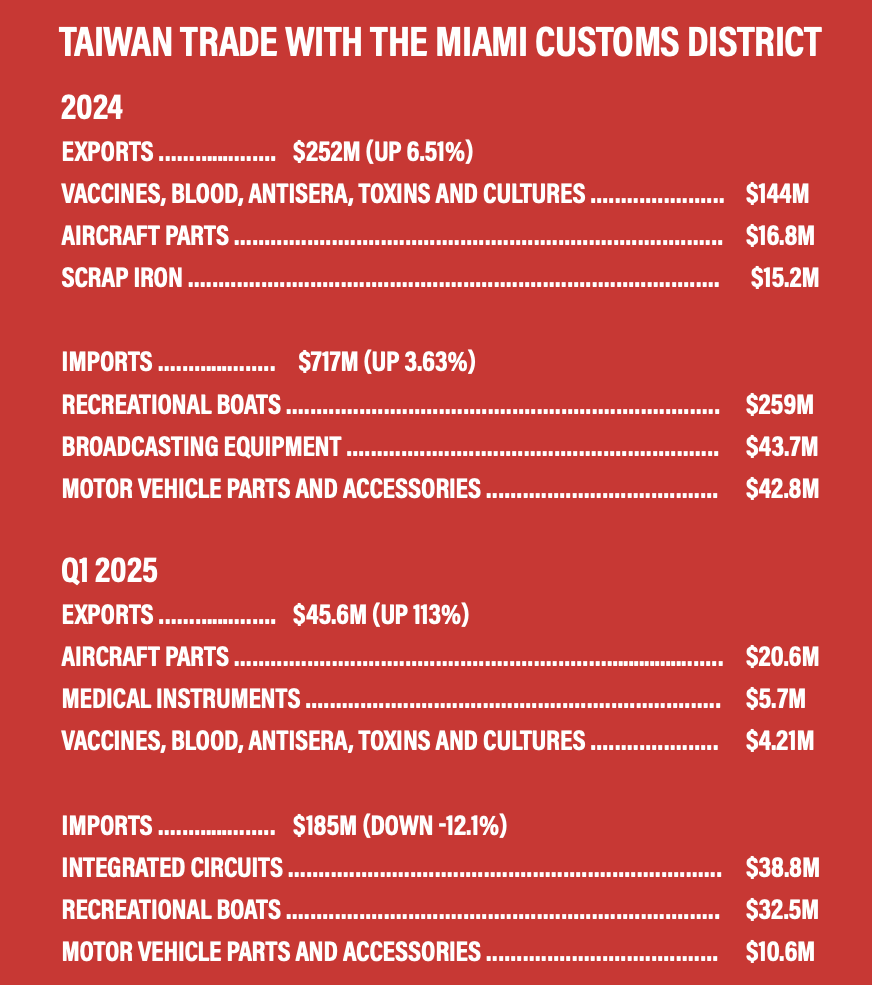

Miami’s exports to Taiwan have experienced moderate yet consistent growth, totaling $252 million in 2024 – a 6.51 percent increase from the previous year. The export profile is dominated by high-value, knowledge-intensive goods, reflecting Miami’s position as a high-tech distribution and logistics hub and Taiwan’s expanding demand for advanced technologies and industrial components.

Leading the way are shipments of vaccines, blood, antisera, toxins, and cultures, valued at $144 million – a sign of Taiwan’s growing investments in healthcare infrastructure and biotech manufacturing. Aircraft parts followed at $16.8 million, while scrap iron shipments reached $15.2 million, continuing a long-standing industrial trade channel.

The momentum accelerated into the first quarter of 2025, with exports surging to $45.6 million – a 113 percent year-over-year increase. Aircraft parts led the surge at $20.6 million, reaffirming Miami’s prominence as a node in the global aerospace supply chain. Medical instruments and pharmaceutical goods also saw notable gains.This uptick in exports comes as U.S. tariffs on Chinese medical and tech goods push global buyers toward non-mainland sources. Taiwan, seen as both reliable and strategically aligned, is benefiting from this pivot.

On the import side, Taiwan continues to anchor Miami’s trans-Pacific trade flows in both consumer and industrial categories. Imports into the Miami Customs District reached $717 million in 2024 – up 3.63 percent from the previous year. Recreational boats led at $259 million, followed by broadcasting equipment ($43.7 million) and motor vehicle parts ($42.8 million), reflecting Taiwan’s strength in niche manufacturing. Yet in the first quarter of 2025, imports fell to $185 million – a 12.1 percent decline compared to the same period last year. While global supply chain normalization played a role, analysts also point to sourcing adjustments related to ongoing U.S. tariff policy, which is encouraging shifts in inventory planning and trade routing across Asia.

Integrated circuits – long considered the linchpin of Taiwan’s export economy – accounted for $38.8 million in Q1 imports, while boat and vehicle parts remained stable.

The Miami-Taiwan economic relationship cannot be viewed in isolation from the broader reconfiguration of U.S. trade in the Indo-Pacific. As multinationals reduce exposure to mainland China, Taiwan has emerged as a preferred alternative for high-tech sourcing.

This realignment has been amplified by recent U.S. tariff hikes on Chinese goods, particularly in strategic sectors such as semiconductors and EVs. While Taiwan has avoided direct penalties, the redirection of global supply chains is pushing more trade – and trust – toward Taipei.