From growing trade to direct investment in both directions, the Miami-Mexico link gains strength

Just 20 minutes from Brickell City Center, the gleaming new Plaza Coral Gables reflects more than just the light glinting off its Mediterranean façade. It symbolizes the growing impact of Mexican investment in Florida, and the growing relationship between Greater Miami, Mexico City, and the Mexican Gulf ports that ship products to the U.S.

The Plaza Coral Gables, in the heart of this suburban multinational community, is the latest project by Agave Holdings, the U.S.-based real estate subsidiary of Mexico’s storied Cuervo family. Backed by decades of entrepreneurial expertise in U.S. real estate – including office buildings in Chicago, New York, and elsewhere in the Gables – Agave Holdings has delivered this posh Miami-Dade municipality its largest mixed-use development to date: a $600+ million, 2.5-million-square-foot project that’s redefining its role as a hub for global businesses. A mixed-use project with apartments, restaurants, stores, the new LOEWS hotel, and open public space, it has two office towers now fully leased with clients like Bacardi, Apple, Bradesco, Raymond James, PNC Bank, and Oppenheimer.

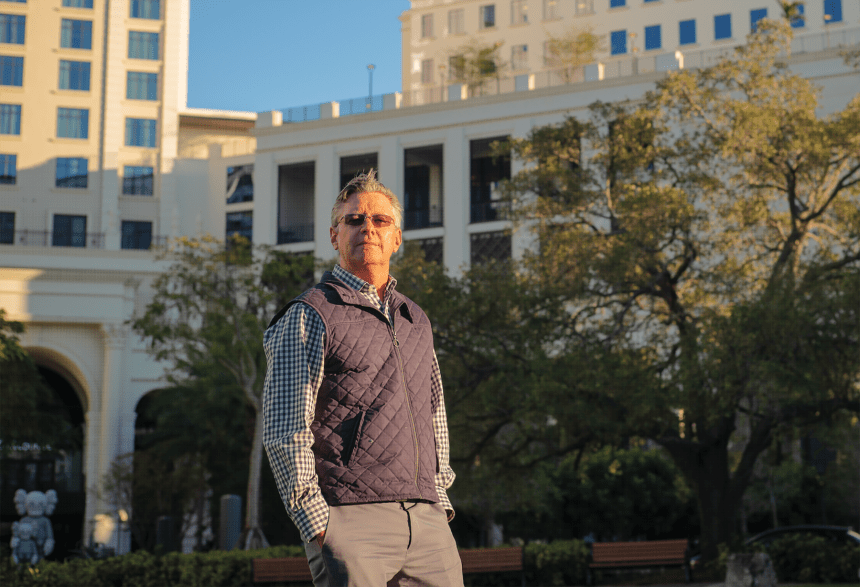

“The success was expected,” says Carlos Beckmann, Managing Director of Agave Holdings and a proud steward of the Cuervo family legacy. Beckmann began overseeing the project after years of experience directing the construction of everything from Miami’s federal courthouse to high-end resorts in the Caribbean and Latin America.

Back in 2015, he was tapped by Mr. Juan Beckmann, CEO of the company that makes José Cuervo tequila, which had been strategically expanding into high-growth U.S. real estate markets like Miami.

Beckmann had previously worked in Texas, a place where he says Mexican workers “many times end up being second-class citizens.” For him, “Miami was very refreshing,” a place where the Hispanic community is so proud of their heritage that they speak Spanish rather than English. “That doesn’t happen in Texas or New Mexico or Arizona,” he says. That welcoming culture was just one of the reasons why Agave Holdings bet big on South Florida. “Miami has always been the gateway,” he says. “It’s not just the connection to Latin America; it’s the Caribbean, the East Coast, and beyond. For Mexican companies, it’s the best in the hemisphere.”

Traditionally focused on California and Texas, Mexican firms are now looking eastward, drawn by Miami’s surging economy and unique Latin American connectivity They are also looking to South Florida– both Miami and Fort Lauderdale – as entry points to the U.S. East Coast markets and links between these two powerhouse economies.

MEXICAN FDI IN FLORIDA

The economic ties between Florida and Mexico have solidified in recent years, as Mexican investment continues to play an important role in the state’s growth. Since 2021, Mexico has been the 13th-largest foreign investor in Florida, with Mexican-owned companies employing 24,200 Floridians, and is accounting for a growing slice of Mexico’s total FDI in the United States, which stood at $38.3 billion in 2023.

In South Florida, several high-profile Mexican companies have established a strong presence. IUSA, a Mexican industrial conglomerate, brought its expertise to South Florida more than a decade ago through its subsidiary, IUSA Water. The company’s Director of International Sales, Luis Garcia-Fanjul, says that a local law requiring individual water meters in new construction fueled their expansion, with operations now spanning Miami-Dade, Broward, Palm Beach, and Monroe counties.

Garcia says their business model focuses on selling water meters directly to homeowners’ associations, who manage water usage in multi-unit buildings. “Miami-Dade County doesn’t supply meters to apartments; they don’t want to deal with it. That’s where we come in,” he says, emphasizing IUSA’s unique position as both a licensed vendor and the sole manufacturer of its own products in the market. While the meters are currently made in Mexico, Garcia confirmed plans to begin manufacturing in Florida due to growing demand.

Grupo Mexico’s $2.1 billion acquisition of the Florida East Coast Railway (FEC) in 2017 marked another significant milestone in Mexican investment in Florida. The deal, which made Grupo Mexico the largest Mexican investor in Florida, has created a vital logistics artery for the state. “We own 361 miles of railroad that runs from Jacksonville to the Port of Miami,” said Luis Hernandez, who is Vice President of intermodal sales for FEC, a fully owned subsidiary of Grupo Mexico Transportes. The railway is a lifeline for goods ranging from construction materials to consumer products for major clients like Walmart and Amazon.

Hernandez says the decision to acquire FEC stemmed from Florida’s strategic importance. “The FEC came to be the best return on investment, the best place to be,” he said, adding that Florida’s rapid economic growth made it an attractive target. Beyond transporting goods, FEC has allowed Grupo Mexico to test and implement innovations that are applied back home – solutions for managing rail crossings in densely populated areas, for example, a unique challenge in Florida.

Grupo Mexico’s acquisition has also strengthened trade between Mexico and Florida. By using its ownership of railroads on both sides of the border, the company facilitates the movement of goods like Mexican beer brands Corona and Modelo. “We’ve been working to leverage our relationships with customers in Mexico that export to the U.S. and help them find the most efficient ways into Florida,” said Hernandez.

Other Mexican companies are also discovering a growing market in Florida, where their products resonate with Latin American consumers. A prime example is Grupo Bimbo, one of the world’s largest bread-manufacturing companies with a presence in over 33 countries. Listed on the Mexican Stock Exchange, the company boasts an annual sales volume of $15 billion. “A lot of the types of breads, pastries, and snacks they make are very attractive to the Latin taste in Miami,” says Kenneth Smith Ramos, Chairman of the U.S.-Mexico Bilateral Committee for COMCE (Mexico Foreign Trade Council). Cinepolis, Mexico’s world-class cinema chain, also found fertile ground in Miami; its Dallas-based U.S. arm added a cineplex in Coconut Grove, one of 26 theaters it now operates across states including Florida, Southern California, New York, and Texas.

Greater Miami is also home to other prominent Mexican enterprises. Mexican-owned media giants Televisa and Univision, which merged in a landmark deal in 2021, have a strong foothold in South Florida with news and entertainment networks. But no story about Mexican investment in Florida would be complete without Cemex, Mexico’s largest cement company, the world’s third-largest producer, and a heavyweight in Florida’s construction industry. Its sprawling Miami Cement Plant, acquired as part of a 2007 global deal to take over the Rinker Group, supplies the raw material for Miami’s high-rise skyline and Florida’s insatiable demand for new construction.

Overall, Cemex’s footprint includes a robust network of ready-mix plants and distribution centers throughout Florida. The company employs over 3,000 people statewide, 600 in Miami, at 32 plants that contribute to economic growth and sustainable building practices. (In Miami, for instance, Cemex is investing in technologies that reduce the carbon footprint of its cement production.)

Eugenio Lopez Negrete, a Mexican industrial engineer and founder of Quantum Business Brokers, has spent years facilitating cross-border transactions for companies aiming to grow through acquisitions. “Florida is super pro-business,” he explains. “Starting from Florida is a better launchpad than starting from any other state because of the pro-business ambiance here and the availability of different business alternatives, especially logistic providers.”

Lopez says that while Mexican businesses have traditionally expanded into the U.S. via the West Coast, Florida’s advantages have shifted this dynamic. “We found that there are already some U.S.-wide businesses based in Florida that are very successful in growing into the whole United States,” he says. When you add South Florida’s Spanish-speaking population and Latin-influenced business culture, “Miami is a much friendlier way to enter the United States,” he says. Additionally, Miami’s role as a logistics hub cannot be overstated. “The cost of logistics makes more sense having Miami in the middle for their global expansion, meaning not only the U.S., but for Europe and the rest of Latin America,” Lopez says.

Mowery & Schonfeld, a tax and advisory firm with a strong presence in Miami, also works to structure and optimize business operations for Mexican companies entering the Florida market.

Ricardo Williams, International Tax Principal and Market Leader at Mowery & Schoenfeld emphasizes the importance of understanding regulatory and tax requirements early on. “Taxes play a very significant role—over one-third of whatever business you are planning to do,” he says, noting the firm’s connections through GGI, a global alliance of tax and advisory consultancies that also allow them to provide on-the-ground expertise in Mexico.

Lopez believes the Mexico-Florida relationship will only deepen in the coming years, especially as Florida solidifies its position as a hub for Latin American business. “The number of opportunities by being here are much better than being in an alternative location,” he says. Miami’s vibrant culture and reputation as a beautiful place to live and work further enhance its appeal. As Lopez puts it, “Why not do business from Miami? It’s fun—maybe more fun than many other options.”

For Mexican companies entering the Florida market, the United States-Mexico Chamber of Commerce, Inter-American Chapter (USMCOC) plays a crucial role in connecting them with local stakeholders. “The Chamber is a great door to open,” Enrique Musi, President of the USMCOC, explains. “We have strong relationships with companies across the U.S. and Mexico, as well as key government contacts.”

The Chamber helps companies navigate regulatory hurdles, understand tax policies, and connect with financial and legal professionals. The Chamber is currently expanding its reach, with a goal of growing from 100 to 300–400 companies in the next two years.

“We’re seeing more Mexican family offices setting up in Miami, and more business leaders viewing Florida as an ideal place to live and expand their companies,” Musi says. Despite an estimated 800,000 Mexicans living in Florida, the community remains less structured than in cities like Los Angeles or Houston. “The challenge now is to bring this community together, to create the kind of business networks that Cuban and Venezuelan entrepreneurs have already built here.”

U.S. FDI IN MEXICO

Despite recent inroads by China, the United States remains Mexico’s largest source of foreign direct investment, accounting for nearly 39% of all FDI inflows into the country. As of 2023, U.S. investments in Mexico surpassed $144.5 billion, fueling growth across critical sectors such as automotive manufacturing, technology, aerospace, and retail. These investments support over 1.5 million direct jobs in Mexico, while also integrating the country more deeply into global supply chains. Major automakers such as General Motors, Ford, and Tesla are among the companies driving this development.

In South Florida, a lead investor in Mexico is Ryder Systems, a Miami-based logistics giant. Ricardo Alvarez, Vice President of Ryder’s Mexico supply chain operations, outlined the company’s strategic expansions in key regions. “We’ve invested heavily in border operations, including a new 220,000-square-foot warehouse in Laredo, Texas, and expanded yard capacities in Mexico,” he says. “These facilities are crucial for processing shipments smoothly and maintaining our trusted status with the U.S. Customs and Border Protection.” Ryder’s operations span multiple industries, from automotive to aerospace and retail, reflecting the breadth of U.S. economic ties to Mexico. “We handle about 5,000 cross-border shipments per week, with 85 percent of those flowing through Laredo,” says Alvarez.

In Mexico’s real estate market, the biggest player from South Florida is The Related Group, one of Miami’s premier real estate developers. Related is replicating its South Florida luxury condo brand in Mexico with projects like the Thompson Hotel and Residences in Mexico City, a 43-story tower in the heart of Reforma, with a mix of hotel and residential units. “We’re bringing South Florida’s lifestyle to Mexico – right down to the architects and materials we use,” says Related’s Head of Mexico expansion, Jose Motta.

What’s even more striking is the cross-border appeal of these projects. Nearly 20 percent of buyers for Related’s Mexico City developments are from South Florida. “The trust in our brand travels with us,” Motta added. “We deliver on our promises, which is something not all developers in Mexico do.” Related is capitalizing on Mexico’s booming tourism industry as well, with projects from Cancun to Puerto Vallarta that cater to both local buyers and international investors. “Mexico is a big country with over 128 million people and growing tourism. In the coming years, we expect even more U.S. investment as the peso strengthens against the dollar,” said Motta.

The digital economy is also becoming an increasingly significant area for U.S.-Mexico collaboration, with Florida companies playing a key role in shaping the sector’s development. One example is ACI Worldwide, a Miami-based payments technology firm that has established a strong foothold in Mexico. “We enable real-time transactions for major banks and retailers across Mexico,” explains Alberto Olivares, ACI’s Head of Mexico Central America & Caribbean. “Miami connects us directly to Mexico’s growing market,” Olivares added. Indeed, the alignment between South Florida’s tech expertise and Mexico’s digital transformation presents a dynamic area of opportunity

One company that understands this is Olé, a Miami-based life insurance company that is bringing its products digitally to a younger Latin American market, where the young company already has 10,000 policyholders. “Mexico is our number one market,” says Michael Carricarte, CEO of Olé. “It’s a great market because of the demographic and ideological convergence” of the U.S. and Mexico, he says. “There is a really strong emerging middle class that is thinking more globally and thinking in dollars and the long-term protection of U.S. dollars,” he says. “They are bilingual, watch the same TV shows, and order from Amazon.”

Mexico’s insurance market, once dominated by traditional methods, is undergoing a seismic shift toward digitalization, which Olé is capturing. “The average age of a [life insurance] policyholder in Latin America is fifty-five,” says Carricarte. “For Olé, it’s thirty-seven. We are tapping into a whole new market. We digitize it, simplify it, and make it both easy to sell and easy to buy.”

“Young professionals and foreign specialists are driving innovation, transforming an industry traditionally dominated by paperwork into one powered by technology,” says CEO of ProTG Internacional, Jacob Stavchansky. His firm is the global arm of Grupo ProTG, a Mexico-based insurance brokerage that operates a network of 1,600 agents across the Americas. With offices in Miami, the firm expanded its reach through a 2017 merger with World of America, forming the Globalitas Group to strengthen its presence across the U.S., Mexico, and Latin America.

As part of this evolution, Grupo ProTG partnered with Olé Life, allowing customers to secure life insurance in minutes, eliminating the need for traditional paperwork or medical exams. “What might seem standard elsewhere is revolutionary in Latin America, and U.S. companies are uniquely positioned to capitalize on this transformation,” said Stavchansky.

This potential for deeper collaboration is perhaps most evident in Mexico City, the country’s epicenter for business and investment. “Last year [2023], Mexico City attracted $13 billion in foreign direct investment. This year [2024], we’ve already surpassed $14 billion,” said Manola Zabalza, Mexico City’s Secretary of Economic Development. The city’s connectivity – boasting over 30 direct flights to Miami – makes it a natural choice for Florida businesses looking to expand. Zabalza also points to the city’s focus on aligning talent with investor needs. “We work closely with universities to tailor programs for industries like biotech and creative industries. This ensures companies coming here have access to the talent they need,” she explained.

Indeed, Mexico has evolved from just an agricultural economy to an industrial powerhouse, producing high-value goods across sectors like aerospace, electronics, and health products. “Mexico has transformed into a country of engineers and highly qualified labor,” says Gerardo Noriega Avila, Chairman-Executive Manager for Miami-based New Day Food Company, and consultant for Interport Logistics. “Now we can supply much more than only apples and oranges.”

This industrial evolution has opened new opportunities for nearshoring and exports to the U.S., particularly with Florida. “For the last 25 years, most Mexican companies have focused on exporting to California and Texas – markets that are now very mature,” says Noriega. “But Miami is a point of entry to the entire Florida market, the cruise lines, the Caribbean, and even the East Coast.”

TRADE BETWEEN FLORIDA AND MEXICO

In 2023, trade between Florida and Mexico reached an impressive $14.7 billion, surpassing the entire U.S. trade with countries like Portugal or Cambodia. While border states like Texas and California often dominate conversations about U.S.-Mexico trade, Florida has quietly emerged as a significant player for Mexican commerce. Kenneth Smith Ramos, the previous head of the USMCA (U.S. Mexico Canada Agreement) negotiations for the government of Mexico and a key figure in Mexico’s Foreign Trade Council (COMCE), emphasizes the vitality of this relationship. “Mexico is the U.S.’s number one trading partner, and Florida plays a substantial role in this dynamic. The trade between Florida and Mexico supports an estimated 300,000 jobs in Florida alone,” he says.

While total trade with Florida grew by 8 percent last year, the more compelling story is the increase in trade between Mexico and South Florida (comprising the Miami Customs District of Miami-Dade, Broward, and Palm Beach counties). In 2023, South Florida exported $1.44 billion worth of goods to Mexico, up 21.2% from the previous year. Top exports included aircraft parts ($260 million), computers ($126 million), and medical goods such as vaccines and blood products ($99.2 million).

On the import side, trade with South Florida totaled $1.1 billion, with leading categories being unspecified commodities ($223 million), refined petroleum ($129 million), and hard liquor ($104 million). While the 2023 total was down 16.3% from the previous year, this dip was short-lived. From January to October 2024, imports rebounded sharply, rising 24.8% to $1.1 billion, with a surge in unspecified commodities ($404 million) and steady demand for hard liquor ($97.8 million) and refined petroleum ($86 million). Exports during the same period reached $1.25 billion, up slightly by 0.43%, with medical goods ($172 million), aircraft parts ($169 million), and recreational boats ($148 million) leading the charge.

While trade with South Florida represents a relatively small slice of the state’s total trade, that is now changing rapidly as the sea routes between Mexico and South Florida are expanding. According to Manny Mencia, Chair of the World Trade Center Miami, 80% of the commerce between Florida and Mexico once relied on truck and rail transport. Goods were trucked across the border in Texas or California and then loaded onto rail for distribution across the U.S., including Florida. However, most of that trade now moves by sea and air. Of the $14 billion in trade between Florida and Mexico, $9 billion is handled by seaports and airports, leaving only $5 billion – about 36% –relying on land transport.

PortMiami has seen dramatic growth in its waterborne cargo trade with Mexico, particularly with ports in Veracruz and Altamira. “Our trade with Mexico is growing in double-digit amounts,” says Andy Hecker, Assistant Port Director and CFO at PortMiami. In 2023, bilateral trade between the Port and Mexico reached $383 million, up 35.91% from the previous year.

At Port Everglades, the trade relationship with Mexico is also gaining momentum. As of 2023, Mexico ranked as the port’s 18th-largest trading partner, with $377 million in bilateral trade. “We’re continually working to strengthen trade relations with Mexico which predominantly provides non-refrigerated cargo through our terminal customers,” says Joseph Morris, Port Everglades CEO and Port Director.

This growth in trade is being driven by several factors, including increased congestion at U.S.-Mexico land borders and the rise of “nearshoring” manufacturing closer to the Gulf of Mexico than the Rio Grande. But the salient factors are time and money.

The first is time. With new direct shipping routes from Mexican ports to Miami, transit times have been cut significantly—from 14 to 16 days to just a half dozen days. While the largest amount dollarwise of sea trade between Mexico and Florida goes to Jacksonville (largely in the form of imported automobiles), shipping to Miami is three days quicker from Veracruz and two days quicker from Cozumel. “This is a game-changer,” Hecker says. “The shift to direct services has provided better reliability, lower costs, and a quicker turnaround, which creates free cash flow for companies—a major advantage.”

Next is money. Gary Goldfarb, Chief Strategic Officer at Miami-based Interport Logistics, says that using Miami as a port of entry for shipping to cities like New York would slash expenses. According to Goldfarb, it costs roughly $15,000 to move goods over land from Mexico to U.S. East Coast cities, while it costs about $2,000 to ship the same goods to PortMiami and then another $3,000 to truck or rail them up the coast. “The right thing to do is get Mexican trade through PortMiami,” he says. “It’s absolutely the most logical thing in the world.”

Port Everglades is also positioning itself to expand containerized cargo capabilities for manufactured goods from Mexico’s gulf ports. “Nearshoring is no longer just a trend; it’s a permanent shift,” says Robert Barceló, Senior Manager of Business Development for Port Everglades. “We’re seeing significant investments in our infrastructure to accommodate this growth, including the completion of the Southport Turning Notch extension, which added five new berths and increased our crane capacity. These upgrades are designed to attract more logistics firms and support the growing demand for nearshoring partners.”

Hecker also sees the rise in Mexican nearshoring as pivotal for trade, replacing longer, more vulnerable supply chains from Asia. “What we’re seeing is not a tsunami of cargo but a steady, sustainable shift,” Hecker explains. “As older factories in Asia reach the end of their lifecycle, companies are looking to Mexico and Latin America for expansion opportunities. This is especially true for high-value sectors like automotive, aerospace, and medical devices.” For companies like Ryder, the nearshoring movement has prompted significant investments in infrastructure to handle increased demand. “We’ve doubled down on our border operations to support the industries driving this shift,” says Alvarez.

Mexico’s infrastructure development is adding to the trade potential. Among the most ambitious projects is the Trans-Isthmus Corridor, a multimodal transportation hub designed to connect the Pacific and Gulf coasts. The corridor – still as much as a decade from completion – includes a network of upgraded railways, highways, and ports, aimed at significantly reducing transit times for goods moving across Mexico, as an alternative to the congested Panama Canal. “It’s not just about moving goods from east to west,” says Barceló. “It’s about creating an economic development hub that connects Mexican manufacturing with the U.S. East Coast. South Florida stands to benefit immensely as a key gateway.”

Despite these opportunities, challenges remain. One hurdle is the historic reliance on trucking to move Mexican goods across the U.S. As Barceló explained, “Ocean freight has always been at a disadvantage because of the speed of trucking. But with increasing congestion and capacity issues at the border, ocean freight is becoming a more attractive option.” Overcoming this barrier will require a shift in mindset among manufacturers, many of whom have built their facilities around 53-foot trucks rather than 40-foot shipping containers.

THE FUTURE OF TRADE WITH MEXICO

While goods dominate the headlines, the services sector remains a vital component of U.S.-Mexico trade. “Mexico runs a deficit with the U.S. in services trade,” notes Smith Ramos. Key areas include financial services, telemedicine, engineering, and audiovisual processing, reflecting the increasing demand in Mexico for high-value, U.S.-origin services as the Mexican economy modernizes. “The last number I saw was over a $15 billion surplus in the U.S. services trade with Mexico. And I think that’s growing,” says Smith Ramos of COMCE.

Looking ahead, experts are optimistic about the future of Florida-Mexico trade. “We’re just scratching the surface of this relationship,” says Smith Ramos. “With nearly $15 billion in trade, there’s no reason we can’t double that in the next decade.”

COMCE is focused on ensuring that the benefits of the USMCA are fully realized, addressing broader trade irritants. “It’s critical to maintain the advantages of the USMCA and raise awareness about the importance of this relationship at the state and local level,” says Smith Ramos. “Many people don’t realize how much their jobs depend on trade with Mexico. Advocacy and education are key to strengthening these ties.”

That enthusiasm is echoed by best-selling author and geopolitical strategist Peter Zeihan (The Accidental Superpower; The End of the World is Just the Beginning: Mapping the Collapse of Globalization) who underscores Mexico’s unique position in global trade. “Mexico is the most perfect trading partner we could hope for,” Ziehan told Global Miami. “We’ve got complimentary demographic structures and an already integrated industrial supply chain. In a world where China goes away, there is only one country that has the combination of industrial plants and labor force that can even pretend to fill the gap. There are obviously some issues in the relationship, but it’s a family issue.”

As Mexico City’s Zabalza put it, “We’re closer than ever – not just geographically, but economically and culturally.”

That may be so, but as of print time, U.S. President Trump was continuing to threaten Mexico with 25 percent trade tariffs across the board. Announced in November as a way to make Mexico expend resources to curb drug trafficking and unauthorized migration across the border, the tariffs have sparked threats of retaliation from Mexico, fueling financial market volatility and inflation concerns. Commerce Secretary Howard Lutnick suggested a compromise may be forthcoming; after announcing during his address to Congress on March 5 that the tariffs would go into immediate effect, President Trump rescinded the threat for 30 days, leading to speculation that this was indeed a negotiation tactic.