As part of its ongoing mission, the WTCM Signs an MOU with the Dominican Republic

Given its proximity to Florida, it makes sense that the Dominican Republic is one of the state’s closest trading partners. It’s also natural that most of this trade flows through Miami. In 2023, bilateral trade between the Dominican Republic and the Miami Customs District alone amounted to $8 billion, with 2024 on track to match that number.

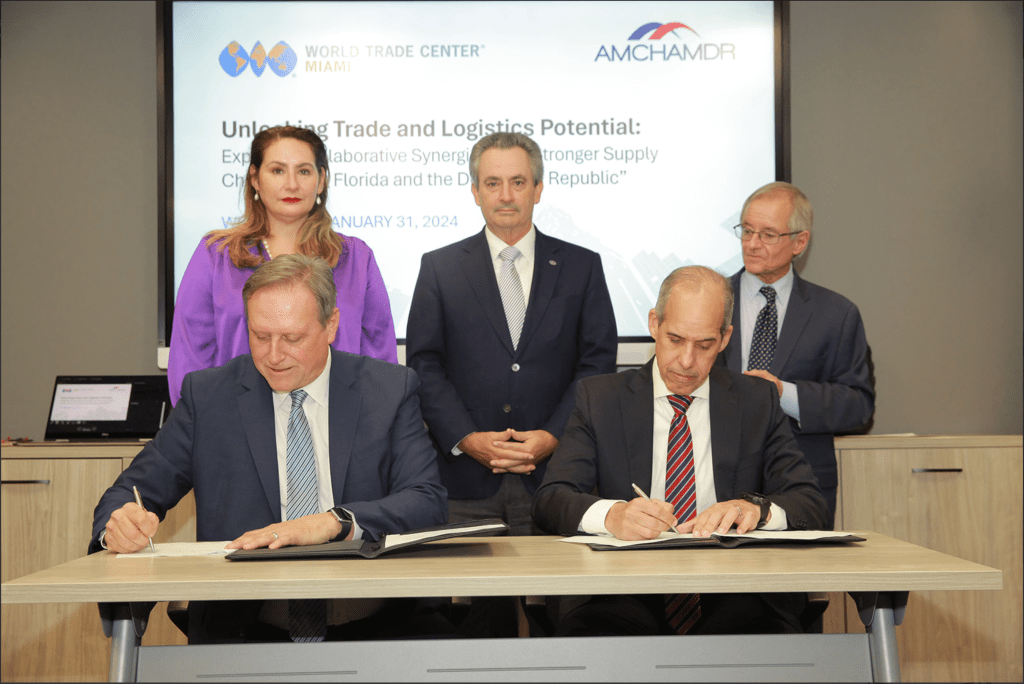

As robust as the relationship is between these two trade partners, it stands to become even stronger with the recent combined efforts of WTC Miami and the American Chamber of Commerce of the Dominican Republic (AMCHAMDR). In January, WTC Miami and AMCHAMDR signed a Memorandum of Understanding to “identify pain points in cross-border trade” and “reduce those barriers for the benefit of both parties,” said William Malamud, executive vice president of AMCHAMDR.

“The Dominican Republic is Florida’s – and Miami’s – largest trading partner in the Caribbean…our objective is to reduce barriers between the Dominican Republic and Florida,” said Manny Mencia, chair of WTC Miami. The new agreement reflects years of collaboration between key industry players intent on making the Dominican Republic the region’s logistic hub. A working trade group created by the agreement features representatives from Miami International Airport (MIA), PortMiami, American Airlines Cargo, Amerijet International Airlines, FedEx Express, UPS, Transtar, Interport Logistics, Aerodom, Punta Cana Airport, CaribeTrans, and Puerto Río Haina (HIT).

The group had its first meeting at the WTC Miami in early June to discuss how it would implement the MoU’s goals. Mencia says the meeting focused on three principal objectives: nearshoring, pre-inspection, and increasing air cargo.

Since the COVID-19 pandemic, disruption in supply chains and production based in China has led many multinational firms to look toward Central America and the Caribbean for nearshoring. While Mexico has attracted most of the firms, the Dominican Republic has positioned itself as a viable option through its manufacturing capabilities, especially in the medical supplies/instruments industry. In 2023, medical instruments were the second-largest import from the DR to the Miami Customs District, and since the pandemic, the country has attracted multinational firms in the industry such as: Cosmed Group, which specializes in the sterilization and pasteurization of medical devices; Fresenius Kabi, which produces a range of blood transfusion and handling products; Edwards Lifesciences, which distributes medical devices worldwide; and Medtronic, which manufactures high-tech medical devices.

The group also focused on establishing more pre-inspection programs for Dominican agricultural products bound for Florida. Mangos are currently among the only produce to receive pre-inspection. “One of the sectors that has grown the most has been nontraditional agricultural products, all kinds of fruits and vegetables,” says Malamud. “But there have been a lot of reject containers that arrive over in Florida for whatever reason – improper documentation, some kind of insect, inappropriate pesticide, et cetera,” Malamud says there are plans to host a delegation of officials from MIA, WTC Miami, the U.S. Department of Agriculture, Animal and Plant Health Inspection Service (APHIS), and the FDA to educate major agricultural producers on how to reduce product rejection. He also says the trade group will facilitate conversation between public entities in the DR and the U.S. for more pre-inspection and pre-clearance programs.

Lastly, the working trade group emphasized the need to increase air cargo. “Most of the cargo between the U.S. and the Dominican Republic comes by sea,” says Mencia. Malamud adds, “Last year, we broke 10 million tourists coming by air. There’s cargo space in the belly of all those planes.” The interest in boosting air cargo is shared by key members of the task force, including American Airlines Cargo, Amerijet International Airlines, FedEx Express, and UPS.