Just before the pandemic, alternative investment giant Blackstone concluded that Miami would be a great location to expand its global footprint. The move turned out to be prophetic.

BLACKSTONE EXPANDS TO MIAMI

In retrospect, the decision by New York-based Blackstone to choose Miami as the location for its second-largest office in the U.S. seemed perfectly in tune with the times. Over the last few years, Miami has become the new home for numerous corporations and corporate divisions relocating from New York, Chicago, and California. The reasons – diversified talent pipeline, a business-friendly environment, safer city streets,and an attractive climate – were all dramatically accelerated by the COVID-19 pandemic.

But Blackstone, in a move overseen by the firm’s Chief Technology Officer (CTO) John Stecher, and Chief Operating Officer of Global Finance Chris Striano, had already decided that Miami was the right fit before the COVID-19 virus triggered a stampede to the Magic City. “At the time, we believed were one of the first financial firms to really plant the flag. So, we had a bit of first mover’s advantage,” says Josh Schertzer, who oversees Enterprise Technology at Blackstone. He is now Co-Head of the Miami office alongside Adam Fletcher, Blackstone’s Chief Security Officer.

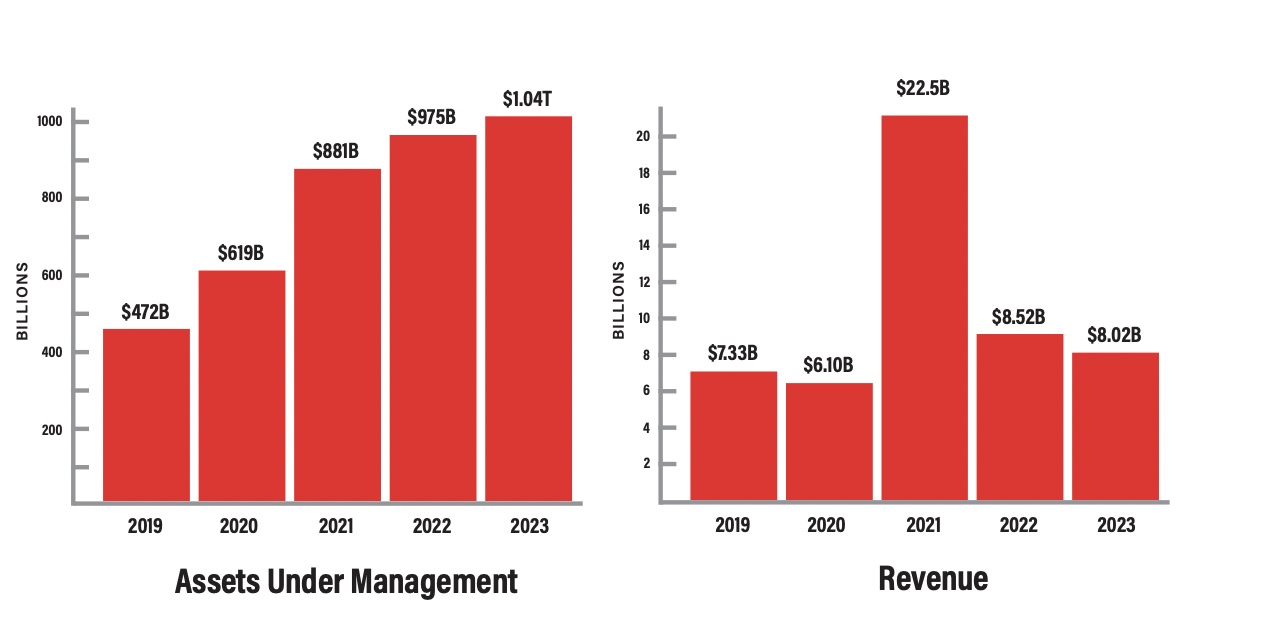

When Blackstone decided to expand to Miami in 2020, Schertzer had been working for the firm for twelve years. When he started it had a mere $94 billion in assets under management. Today it has more than $1 trillion in assets under management, and Schertzer – who arrived with the slender pedigree of two years working the tech side of the New York Stock Exchange – has risen in tandem with the firm’s growing fortune. But it was the timing of Miami and the pandemic that catapulted his career at Blackstone. “We had been looking for a place prior to the pandemic, exploring where we could open up a second headquarters or extension of New York,” says Schertzer. “We were exploring many different cities, the cities that you would expect us to look at. But after careful decision-making, we landed in Miami.”

WHY MOVE TO MIAMI?

Some of the reasons were predictable, starting with “a location where people wanted to be,” says Schertzer, but it went deeper than that. The city had to be a vibrant market, one with a diverse talent pool that Blackstone could tap. This included proximity to good schools, a criterion where Miami scored well with Florida International University, the University of Miami, Miami-Dade College, and nearby Nova Southeastern, not to mention the University of Florida and Florida State University further upstate. “We thought there was an opportunity for us here to recruit out of all these great schools,” says Schertzer.

The presence of huge tech firms in nearby Broward County, like software giant Citrix with 4,600 employees, or KEMET, the electronic components corporation with 3,700 employees mitigated Miami’s lack of present tech talent.

Then there was the closeness to New York, being just a two-and-a-half hour flight away, and in the same time zone – avoiding difficulties inherent in operating a second HQ in some place like California. “People can make it in a day without being disruptive or having to worry about things like being on the West Coast where there is a time difference,” says Schertzer. “When you get into collaboration, it becomes difficult. And we wanted to have real fluidity between these two offices.”

Then the COVID-19 pandemic struck.

“So now we’re looking for a new office and, if you remember, everybody in the entire world was going to go into quarantine for two weeks. And everybody was going to go remote,” Schertzer says. As CTO of Enterprise Technology at Blackstone, Schertzer had a lot of weight on his shoulders. Overnight, his team had to prepare the entire firm to go fully remote.

“If you think about what my team does, it’s all the stuff on the infrastructure side of the house, things that affect productivity and networking. So, how people will work remotely and how they will collaborate and how they’re going to work from home – that was on my team, working closely with Human Resources, and we had to really strategize in a short period of time to mobilize the firm.” At the same time, Schertzer made the personal jump to Miami. He had purchased a condo in the Edgewater area of the city in 2014, a weekend getaway from New York for family and friends. “Two days before the world was going into quarantine, I said to my wife – we had just been married three months – I said that if we are going to get stuck inside our tiny little apartment in New York, let’s go down to Miami. If we’re gonna get stuck, let’s get stuck there.”

The quarantine was supposed to last for two weeks, but of course, it went on much longer – “and that two-week round-trip ticket turned into ‘I’m never going back,’ which was not the intention when I got on that plane,” says Schertzer. Working from Miami, Schertzer successfully completed the task of migrating Blackstone’s workforce to a remote configuration and was then tasked to lead the effort to establish the new office in Miami. By the fall, he and Fletcher had set up operations in a shared workspace. Today there are 250 employees working out of 2 MiamiCentral, primarily made up of Blackstone’s Technology and Innovations and Finance groups, with plans to continue hiring across both teams.

BLACKSTONE’S MOVE TO EMERGING MARKETS

The move by Blackstone is a metaphor for the company’s overall trajectory – a calculated and prescient approach to moving into new, emerging markets. The firm was founded in 1985 by Steve Schwarzman and Pete Peterson, two alumni of now-defunct Lehman Brothers who had worked together in mergers and acquisitions. With a $400,000 investment, over the next three decades, Blackstone grew into the largest alternative asset manager in the world. Deploying funds from large institutional investors and private money managers, they pride themselves on pinpointing “the trends shaping our global economy,” investing directly into everything from real estate to life sciences. With huge amounts of money at their disposal, Blackstone also became the world’s largest alternative asset manager. Schwarzman, 77, remains a highly active CEO (with a personal wealth of $38 billion) who is now continuing to push Blackstone’s further expansion into Europe and Asia.

What makes Blackstone unique is the firm’s wide-net, multi-prong approach to investing and its fervent use of high-tech. Through world-class enterprise software systems, its decision-making process is shared via linked experts in 27 offices globally. “Our investment committee processes are on a global level. I think it’s quite unique compared to other firms,” says Schertzer. “Our team in Asia, for example, has key people in the U.S. that advise on certain investment decisions. They collaborate to that extent.”

Key to these collaborations – between and among the firm’s 60+ “investment strategies” and their teams – is knowledge that is shared across virtual platforms. This is where Schertzer’s expertise comes in. As a Managing Director and CTO of Enterprise Technology, he is responsible for the firm’s technology infrastructure, enterprise workspace, networking, productivity, collaboration, marketing, and private wealth technology, and previously cloud computing. In another example of how Blackstone leverages its human resources, Schertzer is also on the Blackstone Innovations and Investments team, advising on investments in early-stage FinTech, PropTech, Cybersecurity, and Enterprise Tech companies. Taking that a step further, Schertzer advises several Blackstone portfolio tech companies and has sat on the boards of investments he has led.

As for the breadth of Blackstone’s investments, it’s mind-boggling. The largest of their businesses – real estate – has $339 billion in assets under management and owns ~12,500 real estate assets with the market value of the properties estimated at $586 billion, including their own buildings, making them the world’s largest owner of commercial real estate.

Next down the list is the private equity segment, with $310 billion in assets under management and 126 portfolio companies in such categories as life sciences, infrastructure, and energy, companies like Ancestry, Phoenix Tower International, and Copeland (previously known as Emerson Climate Technologies). Another private equity category is “tactical opportunities,” the edgier investments in new technologies, companies like Cryoport (bio logistics), Core-Weave (cloud infrastructure powering AI) and ARKA (advanced military and space technologies).

BLACKSTONE OPERATING WITHIN MIAMI’S TECH ECOSYSTEM

It’s this high-tech edge to Blackstone that makes it such a darling in Miami’s tech ecosystem, with the city’s venture-capital mindset and cadre of cyber startups. Within Blackstone, technology is the backbone, with different verticals run by several CTOs. In addition to Schertzer’s Enterprise Technology vertical, there is one for Liquid Asset Management Technology, Real Estate and Private Equity Technology, Data, Cloud and Developer Experience, Corporate and Finance Platforms and Human Resources Technology.

The software that Blackstone employs is a mix of programs created in house and those imported from third parties. “We’re not going to build an email system when Microsoft Office 365 is available or build a video conference system when Zoom is available,” says Schertzer. “The things that are proprietary to Blackstone which require heavy customization to fit our business model, or just doesn’t exist, we build. So, it’s a combination of build versus buy, depending on the use case.” One area where Blackstone has made strides, says Schertzer,

is in the use of cloud technology. “Under the leadership of John Stecher, who’s the CTO of our CTOs, we made a big push during the pandemic to modernize our infrastructure and migrate to AWS (mega-cloud provider Amazon Web Services), which is now where we are in our final state. And this has unlocked us significantly in terms of [being] more efficient and more productive, because we can build and deploy much faster.”

Other areas of tech focus for the firm, says Schertzer, are cyber-security and automation. The firm’s cybersecurity program is run by Adam Fletcher, the other member of the original Blackstone Miami duo, whose job is to not only protect Blackstone’s intellectual property but to advise its portfolio companies on cybersecurity. As for automation, the goal is to run mundane tasks robotically, so that the firm can stay as lean as possible, and free up personnel for higher functions. This is where Artificial Intelligence (AI) comes in.

“AI is a significant theme for us,” says Schertzer, “Blackstone is exploring generative AI in several ways. On the engineering side, we are working with a generative AI product called Cody, from Sourcegraph, that has the potential to survey Blackstone’s abundant, fragmented codebases and then write codes and create new software to help cut the time needed to deal with those tasks.” They are also exploring rolling out the various “Copilot” and assistant tools from Microsoft, Zoom and Salesforce to help employees be more productive. A third area is the deployment of self-service helpdesk chatbots that aim to provide employees with a more efficient, self-service option for support requests.

On the investment side, Blackstone is building a tool that has the potential to intelligently augment investment decisions by processing the firm’s abundant data across its portfolio. “Call it a deep company analysis or sector analysis using generative AI. That’s a big area that we’re leaning into very early innings… we’ve got a lot of intellectual property around the data and layering a generative AI solution on top of that we think could really benefit the firm.” Allied to that would be AI programs that accelerate finance processes and legal compliance.

BLACKSTONE’S ARRIVAL AND IMPACT

Even without such accelerators in place, the investment performances for various Blackstone funds are among the best out there, though not all are winners. Investments in private equity infrastructure rose 12.1% last year. Investments in private credit did even better, with a 16.4% return. Their opportunistic real estate fund slipped 6.3%, however. Although, slips like this, especially in real estate, do not worry the behemoth; Blackstone is in it for the long run. One legendary Blackstone company – a 71% write-down of its 2007 $26 billion acquisition of Hilton Worldwide – was later turned around by Blackstone when President and COO Jonathan Gray was then Global Head of Real Estate. Blackstone bought back its debt, invested another $800 million, and took Hilton public in 2013 for a $14 billion profit.

With such huge profits, Blackstone remains conscious of the importance of giving back. Drilled into the corporate DNA is the philosophy that it should engage philanthropically where it operates. This was another reason to pick Miami – the idea that Miami was still a young city, a place where a major corporation could make a difference. “It’s very important that any city in which we work is a city where we feel like we can engage with and contribute to, whether that would be volunteering or charitable work. And Miami checked that box as well,” says Schertzer. Among their contributions, the Blackstone Charitable Foundation has committed $5.4 million to establish a LaunchPad program for entrepreneurial skills at seven colleges and universities across Florida (MDC, FIU, UF, FSU, UCF, UNF, and Florida A&M). Since its inception in Miami, Blackstone employees have also contributed 700 hours of community service, supporting Miami-Dade Coastal Cleanup and Miami Waterkeeper, along with a half dozen other organizations.

Schertzer himself serves on various advisory boards across the technology sector and local Miami nonprofits, including the Dean’s Council for Florida International University’s Business School, the Board of Venture Miami STEM Scholarship Fund, and the Board of Directors for Friends of the Underline. “That one – the Underline – is one that I am extremely passionate about and a great way for our local community to transform our urban spaces,” he says. “Meg Daly and the Underline team have done a fantastic job driving this mission forward.”

As for the great experiment of moving Blackstone to Miami, says Schertzer, “We have no regrets for this decision at all. Right now, it’s proving the thesis that we had it right, that we picked the right city…. We are still extremely bullish on Miami as a whole in terms of talent and in terms of growth, so for sure this office will continue to expand and we will continue to invest in hiring folks down here.”

And as for their impact on the city, that has been a win-win. “Blackstone’s arrival into the Miami environment was arguably one of the most powerful signals to the world that Miami has reached the next level hub for technology investment and financial firms,” says Saif Ishoof, founder of Lab22c, a leading Miami-based strategic advisory firm that tracks the region’s tech ecosystem. “It is undeniable when the world’s largest alternative asset manager establishes a strategic footprint in Miami and more importantly when local leaders like Josh and Adam get so actively engaged in our region. I am excited about what the multiplier effect of Blackstone’s presence will be for our innovation economy as well as for talent in the Miami market.”